tax planning services introduction

TAX PLANNING AND RELATED SERVICES I. Introdution Of Topic The Gst Or The Goods And Service Tax Is A Long Pending Indirect Tax Reform Which India H Research Paper Goods And Services Math Projects How.

Tax Planning Bookkeeping Tax Preparation Spring Lake North Carolina

Ad Free price estimates for Accountants.

. Tax is the compulsory financial charge levy by the government on income commodity services activities or transaction. I am pleased to take this opportunity to introduce myself to you and to let you know of the services that I offer. Tim Steffen senior consultant with PIMCO Advisor Education takes us through tax planning strategies for 2021 and beyond including the.

The primary goal of tax planning is to project taxable income adjust the tax estimates and avoid penalties or surprises at tax time. Optimize revenue save taxes and skyrocket your business with simple yet effective tax planning strategies. Tax Planning can be understood as the activity undertaken by the assessee to reduce the tax liability by making optimum use of all permissible allowances.

Tax planning can be a game-changer for small and medium businesses. When it comes to delivering the return to our clients we often have the conversation with them about minimizing their tax liability for next year which seems to align with the offering of a tax planning service. The objective of tax planning is to make sure there is tax efficiency.

The beauty of tax planning is while. Introduction to tax planning and management. Tax planning strategy should be taken on the basis of existing provisions of the tax laws to achieve short term and long term benefits 2.

My name is __ name__ representing __ name of company__. Tax Planning How To Plan Tax Services Income Tax Return Stripe Introduction To Sales Tax Vat And Gst Compliance Guide Indirect Tax Sales Tax Goods And Service Tax Taxes. When it comes to delivering the return to our clients we often have the conversation with them about minimizing their tax liability for next year which seems to align.

We have seen an ongoing approach to artificial tax avoidance which stands between avoidance and evasion. However one of the challenges we face. To avoid any issues down the road starting your tax planning as soon as possible is important.

Tax planning is effectively managing a taxpayers financial situation to minimize the tax burden at the federal and state level for both the near and long-term. A list of hallmarks of tax. An introduction to tax planning 1.

Tax planning is the process of analysing a financial plan or a situation from a tax perspective. The word tax derived from the Latin word. TAX PLANNING Tax Planning is an exercise undertaken to minimize tax liability through the best use of all available exemptions.

In recent years much public attention has focused on the topic of tax avoidance in the light of revelations such as. Concept of tax planningand management Tax evasions and tax avoidance-Need and significance of taxplanning and. An Introduction to Tax Planning Strategies.

Nesso Tax can help you develop a personalized tax planning strategy to save.

How Middle Market Companies Can Manage The Transfer Pricing Life Cycle

Taxwise Tax Preparation Software Wolters Kluwer

Chapter 1 Notes Chapter 1 Introduction To Tax Notes The Primary Purpose Of Taxation Is To Raise Studocu

Introduction To Taxation Financial Advisers Investment Wealth Management And Pensions Advice Premium Financial Planning Services

Introduction Stevens Foster Financial Advisors

Manual For The Control Of International Tax Planning Inter American Center Of Tax Administrations

Estate Planning An Introduction Professional Tax Services

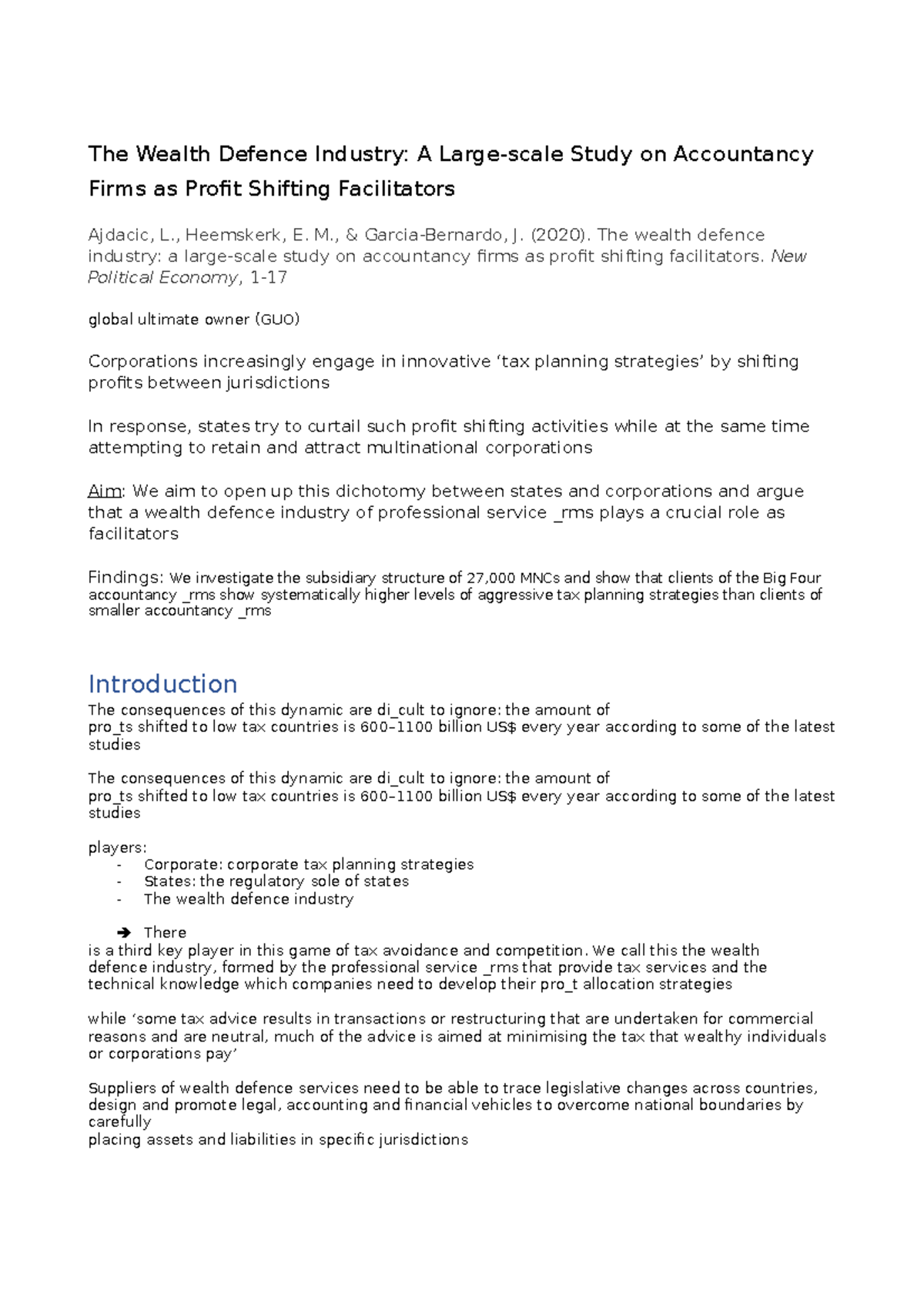

The Wealth Defence Industry Notes Psci A188 Occ Studocu

1 Foundations V2 5 Apeg Advanced Planning Educational Group

Calameo Importance Of Tax Planning Services

Pdf Tax Planning Preparation And Related Issues For The Americans Living Abroad By Compliance Global Inc Compliance Global Inc Academia Edu

Income Tax Preparation Small Business Accounting Dartmouth Ma 508 496 7168

Solution Introduction To Tax Management And Tax Planning Studypool

Tax Planning While Being In Singapore Tax Planning Services

Finsolve Estate Planning Services Introduction

64 Estate Tax Compliance And Tax Calculation Financial Planning Competency Handbook 2nd Edition Book